Can you believe it’s March already! Let the madness begin.

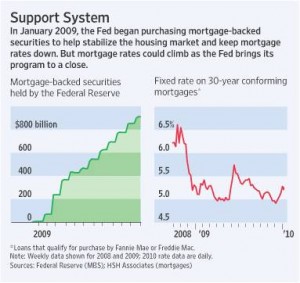

It seems the local real estate market has broken into the frenzy a bit before the NCAA. There are many buyers jumping into the market to ensure their purchase is booked before the April 30th deadline for the tax credits ($8,000 or $6,500 depending on the situation). It is going to be a very interesting year, especially with the expiration of these credits and the government’s plan to halt the purchase of mortgage backed securities on March 31st.

The biggest question remains, what will life be like after the programs abate. Can the market support itself on its own two feet or has the past fifteen months been fueled completely by the government’s intervention. Even in steadier times, it would be difficult to predict the market’s ability to swallow such massive changes.

Just to keep things in perspective, by the end of March the government will have purchased $1.25 trillion on the mortgage backed security program. By some estimates, nearly 75% of this mortgage security market since implementation (January 2009).

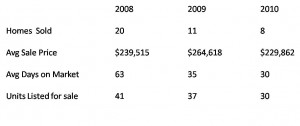

Let’s get a feel for where we are at this point relative to years past. (Conshohocken-thru end of Feb)

Certainly, we can slice and dice these figures anyway we want. What I find most interesting in this year’s numbers is the decrease in number of unit’s listed. Yes, the supply is down and that coincides with what we are seeing and hearing from buyers. It seems buyers are ready and willing, but things are moving faster then they realize.

Certainly, we can slice and dice these figures anyway we want. What I find most interesting in this year’s numbers is the decrease in number of unit’s listed. Yes, the supply is down and that coincides with what we are seeing and hearing from buyers. It seems buyers are ready and willing, but things are moving faster then they realize.

The interesting scenario is for most of the nation (according to national market statistics) supply and demand are way out of sync (supply outweighing demand). Here in town, we have the opposite. And that makes for an interesting situation. Buyers are ready to get involved quickly, but what will happen when the programs stops?

It’ll be interesting for sure. We’ll be sure to check back in on the numbers!

— MM